Global insurance-technology firm bolttech has acquired Kenyan digital insurer mTek, a deal that promises to reshape how Kenyans and East Africans access insurance. The acquisition underscores bolttech’s ambitions to expand across Africa and bring digitally enabled, embedded insurance solutions to emerging markets.

Founded in 2019, mTek has grown into a leading digital insurance distribution platform. Its mobile-first, paperless system enables customers to compare, purchase, and manage insurance products online, a feature that has attracted partnerships with major underwriters such as GA Insurance, Sanlam and Britam.

In September 2025, mTek and Mastercard joined forces to launch embedded-insurance offerings across East Africa, a move that underscores growing demand for simplified, tech-driven protection services in the region.

Under the agreement, mTek will retain its existing leadership team and continue operations under its current structure, at least during the integration phase. This is expected to reassure customers, partners and staff amid the transition. Eventually, mTek will be rebranded under the bolttech name.

For bolttech, the acquisition represents both strategic expansion and a milestone entry into East Africa. The company said the move will enhance its global embedded-insurance capabilities while leveraging mTek’s local expertise and technology stack.

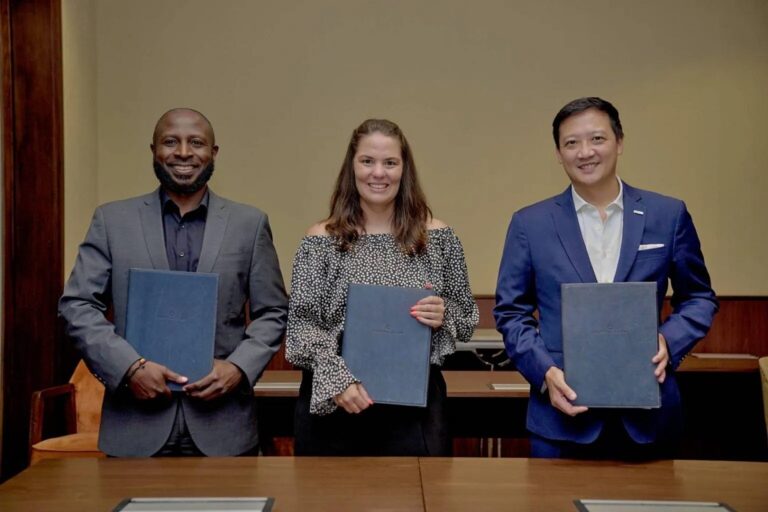

“This represents an exciting step forward for bolttech as we expand our footprint in Africa. mTek’s innovative platform and talented team share our vision of using technology to make protection more accessible.

Together, we can accelerate digital-transformation in insurance and extend the reach of embedded protection across the region,” said Stephan Tan, bolttech’s Regional CEO for Europe, Middle East and Africa (EMEA).

Echoing this optimism from the mTek side, CEO Bente Krogmann said the acquisition marks a new chapter: “Our technology, local insight, and commitment to inclusive insurance have transformed how customers access protection in Kenya, and this partnership allows us to scale that impact even further — bringing more innovative and relevant insurance solutions to customers at scale.”

The deal is notable not only for what it delivers today, but also for its broader implications. For bolttech, gaining a license-ready entry point into Kenya gives it immediate access to one of Africa’s fastest-growing digital insurance markets, without having to build everything from scratch.

mTek already serves more than 350,000 customers, offers access to over 45 insurers, and has a track record of delivering digital, flexible, and customer-friendly insurance experiences.

For Kenyan consumers, the acquisition could accelerate access to more diverse, modern insurance products, with the added backing of a global player known for scalable embedded-insurance solutions. The enhanced technology, capital base, and global network could help close the insurance-penetration gap that persists in much of East Africa.

From a broader perspective, the transaction signals growing international confidence in African insurtech. The acquisition, one of the few high-profile exits in East Africa in recent years may encourage other startups and investors to view the region as a viable, long-term market for digital protection and financial-inclusion services.

In August, bolttech announced a partnership with LOOP, the digital banking service from NCBA Bank. The move expands bolttech’s presence in Africa and brings its embedded protection and insurance solutions to one of the continent’s most dynamic and fast-growing digital economies.

Through this partnership, bolttech and LOOP launched a new product, LOOP Flex Device Financing (LOOP Flex). The programme is designed to make it easier and more affordable for customers to own the devices they rely on while ensuring they are fully protected.

The solution combines flexible financing with comprehensive, embedded device protection integrated seamlessly into the LOOP customer experience. It covers theft, accidental and liquid damage, mechanical breakdown, and extended warranty, with all repairs handled at certified service centres using genuine parts.

Do you have any story or press releases you want to share? Send tips to editor@envestreetfinancial.com

Follow us on Twitter, Facebook, or LinkedIn to ensure you don’t miss out on any