The Kenyan government has confirmed that the Kenya Pipeline Company NSE listing will take place this January, marking a major milestone in the nation’s efforts to open up strategic state-owned enterprises to public investment and deepen the domestic capital markets.

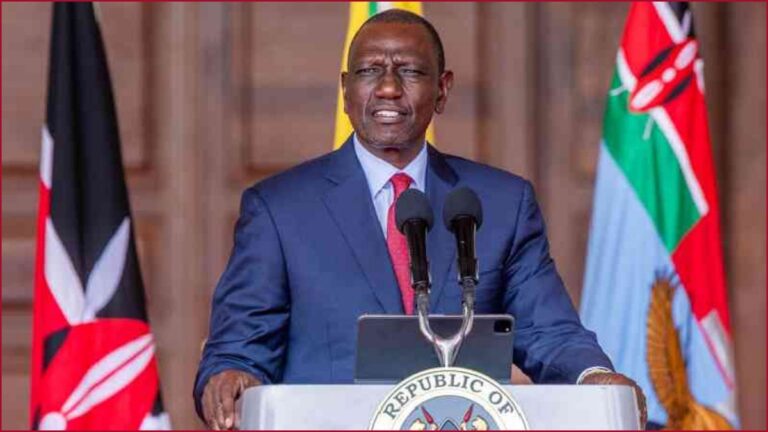

In an announcement made on 4 January in West Pokot, President William Ruto said the planned market debut of the Kenya Pipeline Company (KPC) on the Nairobi Securities Exchange (NSE) will enable ordinary Kenyans, even those with very modest savings to buy shares and benefit from future profitability.

“We have said the shares will be sold to everyone. Even if you have Sh200 or Sh300, come and buy … so that when profits are announced, you are part of it,” Mr Ruto said, emphasizing the inclusivity of the process.

KPC is a state-owned midstream petroleum logistics company responsible for transporting and storing petroleum products across Kenya and into neighboring countries.

Its infrastructure, including extensive pipelines and storage terminals, is considered critical to the East African energy market.

The planned Kenya Pipeline Company NSE listing forms part of the government’s broader strategy to unlock value from public assets, reduce reliance on domestic borrowing, and strengthen transparency and corporate governance.

The listing of KPC follows a policy shift that has seen the Kenyan government re-evaluate the role of state enterprises in the economy.

It aligns with previously announced plans to partially privatize selected firms to improve efficiency and raise capital for national development.

Under the current framework approved by Parliament and the Cabinet, up to 65% of the government’s stake in KPC may be offered to public investors, with the state retaining at least 35% to safeguard wider national interests.

Treasury officials have stated that the proceeds from the listing will support KPC’s expansion plans, including regional infrastructure projects and diversification into related energy services and also contribute to broader fiscal priorities without increasing public debt.

Opening up KPC to public investment is expected to deepen Kenya’s capital markets by broadening the investor base and improving market liquidity.

Financial analysts have pointed out that a successful listing could enhance the NSE’s profile as a competitive African exchange.

Mr Ruto also confirmed that the offer would extend to regional partners, including investors from Uganda, as part of a broader drive to attract cross-border capital and strengthen regional economic integration.

For many ordinary Kenyans, the opportunity to own shares in KPC represents a new avenue for personal wealth creation.

The President pitched the listing as a chance for ordinary citizens to participate directly in national development and benefit from the profits of one of the country’s most profitable state corporations.

However, the privatization and listing process has not been without controversy. In 2025, a High Court temporarily halted earlier attempts to sell shares in KPC pending legal challenges, underscoring persistent public concerns about transparency and valuation.

Lawmakers have also debated the implications of divestiture, pushing for clearer safeguards around valuation and citizen involvement.

Recent parliamentary sessions laid out requirements for retaining strategic ownership and ensuring that transaction proceeds are used to promote socio-economic development.

Market players and potential investors are now awaiting the release of the formal Initial Public Offering (IPO) prospectus, which will outline the offer size, pricing, and timetable.

Financial advisers and transaction leads are expected to be appointed imminently to steer the listing process to completion.

If finalized as scheduled, the Kenya Pipeline Company NSE listing could be one of the most significant stock market events in Kenya in recent years, comparable to major offerings such as Safaricom’s flagship IPO in 2008.

Despite earlier delays and legal setbacks, the government’s renewed commitment reflects a strategic push to enhance market participation, mobilize long-term capital, and distribute ownership of national assets beyond the corridors of power.

Do you have any story or press releases you want to share? Send tips to editor@envestreetfinancial.com

Follow us on Twitter, Facebook, or LinkedIn to ensure you don’t miss out on any