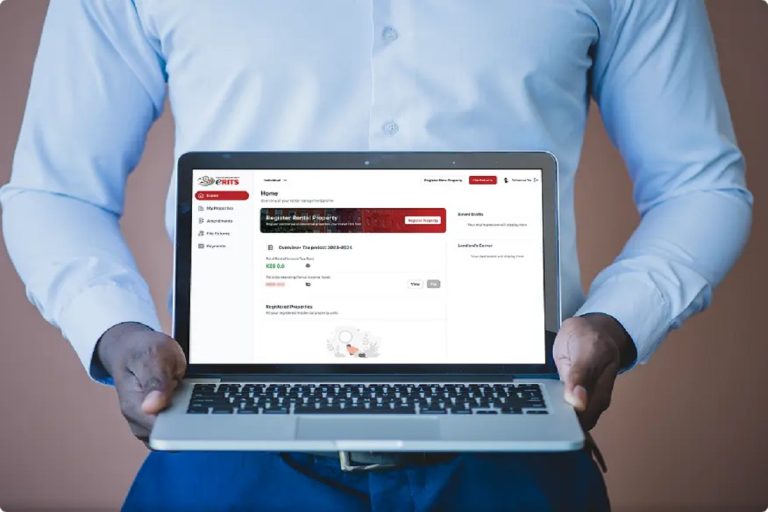

The Kenya Revenue Authority (KRA) has launched a new digital platform designed to simplify how landlords declare and pay taxes on rental income. The Electronic Rental Income Tax System (eRITS), is aimed at streamlining property management and easing compliance with monthly rental income (MRI) obligations.

Officials say the system will allow property owners to manage rental information, update property records, and make tax payments through a simplified and centralised process. The move forms part of KRA’s wider strategy to digitise tax administration and broaden compliance among property owners across the country.

“The system enables management of properties, filing and payment of rental taxes in a simple and convenient way,” the agency said in a statement.

Through the eRITS portal, accessible via erits.kra.go.ke or the eCitizen public portal, landlords are required to update or correct their property details and submit rental income records. KRA has urged all property owners earning rental income to onboard their properties into the system as part of an effort to improve accuracy in tax collection.

For landlords, compliance with rental income tax has long been a challenge, with gaps in reporting leading to losses in government revenue. By introducing eRITS, KRA aims to seal these loopholes while making it easier for property owners to avoid penalties associated with late or incomplete filings.

MRI is payable by a resident person (individual or company) on rental income accrued or derived in Kenya for the use or occupation of residential property.

Following the enactment of the Finance Act 2020, MRI is applicable to persons earning rental income which is in excess of two hundred and eighty thousand shillings but does not exceed fifteen million shillings during any year of income. with effect from 1st January 2021.

KRA has committed to supporting taxpayers with tools and systems that make compliance easier. The agency emphasised that eRITS is part of ongoing reforms to modernise Kenya’s tax collection framework.

“KRA is committed to continue supporting and facilitating all taxpayers to comply with the requirements of the existing laws through simplified solutions,” the notice stated.

Kenya has been working to expand its tax base amid rising public expenditure and growing debt obligations. Rental income has been identified as one of the under-tapped revenue sources, with many landlords historically failing to declare their earnings.

The Kenya Revenue Authority surpassed its revenue target of KSh2.555 trillion for the 2024/2025 financial year, collecting KSh2.571 trillion. This represents a growth of 6.8% and a performance rate of 100.6%, compared with the KSh 2.407 trillion collected in the previous financial year, marking one of the highest revenue performances in recent years.

By expanding the tax base with the aim of onboarding taxpayers who were previously not paying taxes and converting inactive taxpayers into active ones, the programme enabled KRA to collect KSh24.9 billion in revenue.

Some of the initiatives under the Tax Base Expansion (TBE) programme include the launch of the Electronic Rental Income Tax System (eRITS), which has enhanced visibility of rental properties, rental income, and occupancy status; recruitment of landlords under the Monthly Rental Income (MRI) programme through a taxpayer mapping process known as the Block Management System (BMS); as well as the registration of additional taxpayers and assignment of further tax obligations based on their income.

The introduction of eRITS is expected to improve transparency and increase compliance levels within the real estate sector.

The Monthly Rental Income tax, introduced in 2016, requires landlords to pay 7.5% of their gross rental income, effective from 1 January 2024, capped at KSh15 million annually. Despite this, compliance has remained a challenge, partly due to lack of awareness and difficulties in filing returns.

By offering a digital, user-friendly option, KRA hopes to remove barriers that have previously discouraged landlords from formalising their tax obligations.

The roll-out of eRITS represents one of several steps KRA is taking to digitise tax collection, alongside efforts to integrate other revenue streams with eCitizen.

Do you have any story or press releases you want to share? Send tips to editor@envestreetfinancial.com

Follow us on Twitter, Facebook, or LinkedIn to ensure you don’t miss out on any